The impact of EU funds on the domestic economy

On 1 May this year, we celebrate the 21st anniversary of our accession to the EU. Our membership of the EU has brought many hard-to-quantify economic benefits: duty-free EU exports, an influx of working capital and free movement of labour. These are much easier to capture than the effects of EU cash subsidies, as summarised by GKI.

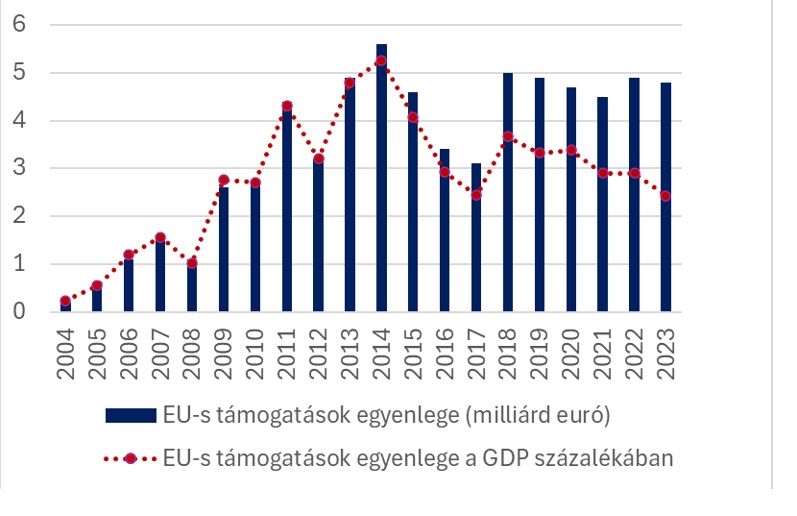

- Between 2004 and 2008, the amount of EU money spent was relatively modest compared to later years, accounting for 0.2-1.6% of domestic GDP.

- In 2009, the indicator stood at 2.8%, and after a rapid rise, it peaked at 5.3% in 2014.

- After a peak year, it was again on a downward trajectory, but even in the weakest year of 2017, we enjoyed a subsidy of nearly 2.5% of GDP.

- From 2018 to 2023, €4.5-5 billion per year stimulated our country's economy, equivalent to 2.4-3.7% of GDP.

Over the period since EU accession, Hungary has received a total of €67.8 billion in net aid (HUF 21 600 billion. This is equivalent to 26% of domestic GDP in 2024, or more than a full year's worth of domestic investment. On average, 2.8% of annual GDP net inflows have been received after 2004 (3.5% of annual GDP after 2010).

Balance of EU aid in nominal terms and as a share of GDP (billion euros, %)

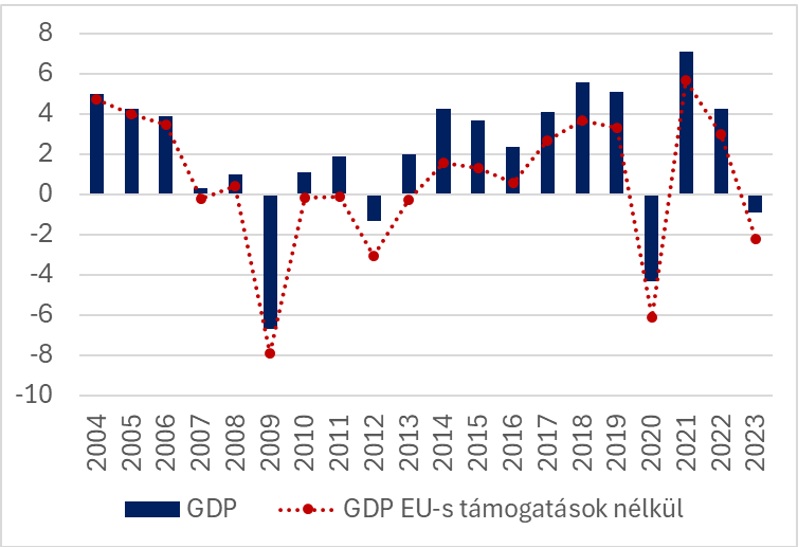

Source. From GKI macro model (GDP without EU subsidies) and HCSO (GDP)

The GKI's macro-model has been used to calculate the impact on the domestic economy

.

Over the period 2004 to 2023, average annual GDP growth would have been 0.7% without EU aid, compared with an average of 2.1% with EU aid. The annual average GDP impact was therefore 1.4%, double the growth from self-financing.

GDP change and GDP change without EU subsidies (%)

EU funds have had a positive impact not only on economic growth, but also on the budget.On the one hand, EU funds have triggered direct public spending, such as direct agricultural subsidies (land-based support), which are paid directly to farmers by the EU under the Common Agricultural Policy (CAP), and thus did not have to be borne by the Hungarian budget. Likewise, increases in teachers' salaries through EU co-financed operational programmes have also reduced domestic wage expenditure in the education sector.

On the other hand, indirect subsidies from the EU, channelled through the state coffers, have mitigated the budgetary burden of public investment.

Examples:

- funds for infrastructure development (roads, motorways, railways, etc.) and energy modernisation of public institutions

- Similarly, innovation and research and development grants to boost competitiveness were largely paid out under EU programmes.

- Labour market programmes (retraining, public employment projects, youth guarantee programme) also benefited from significant EU co-financing, thereby reducing the domestic financing needs for social policy spending.

- Improvements to educational and health infrastructure, such as the renovation of schools, kindergartens and hospitals, were also often co-financed by EU funds.

The projects implemented have also supported the budget from the tax revenue side; between 2010 and 2023, around 40% of the net EU payments were on the revenue side of the general government, which, excluding the 15% own contribution (additional domestic budgetary expenditure), represents a net revenue of almost 30% of expenditure. This is on average 2.5% of annual budgets, or the improvement in the budget balance.

It is also worth noting that EU funds were often used with limited efficiency and were often overpriced. Despite this, the economic benefits of our membership of the EU are indisputable and have served as an engine of economic expansion in Hungary over the past decade and a half or two decades.